China Shipping: How to become a butterfly?

- Date: Jun 13, 2016

- Comments: no comments

- Categories: News

Previous Chinese companies will be able to believe that big and strong. Therefore, all walks of life for over ten years shouting bigger and stronger. Although many enterprises in volume early into the world’s hundred, ten, and some even become the world’s unity. But still suffers the ups and downs in the global economy, it is difficult turn.

Today’s Chinese companies in turn put the platter made “God” posture, seems to be the “Chinese God car” on the stock market from the onset of China South Locomotive, CNR merger, important domestic industry leading enterprises who are contemplating and deductive the merger story, shipbuilding news about north and south, three major airlines, petrochemical planes, Baosteel, Wuhan Iron and steel merger after another, “God car China”, “China Shenzhou”, “Chinese God Games”, “China Kobelco” ” China power of God, “and so the concept of flying in the stock market. One like “God” on the soul, such as One panacea so that enterprises can immediately Yuhuachengxian in the stock market bullish.

Today enterprise advocates “God” is actually bigger replica. Integration of central enterprises once again set off a tide of Chinese enterprises bigger and stronger. Once upon a time, the concept of integration of state-owned enterprises like oven bread, baked in the heat of fermentation expansion. In mid-April last year, the amount of Group President expressed the hope that in 2019 the completion of the injection of assets in the amount of the original amount, oil, sugar, etc., to achieve integration and the overall market tripartite assets; State funded coal industry consolidation fund, One step into the coal industry to speed up the integration of messages flooded the media; and China power investment Corporation and the State nuclear power technology Co., Ltd. merged to form the national power investment Corporation has become a reality.

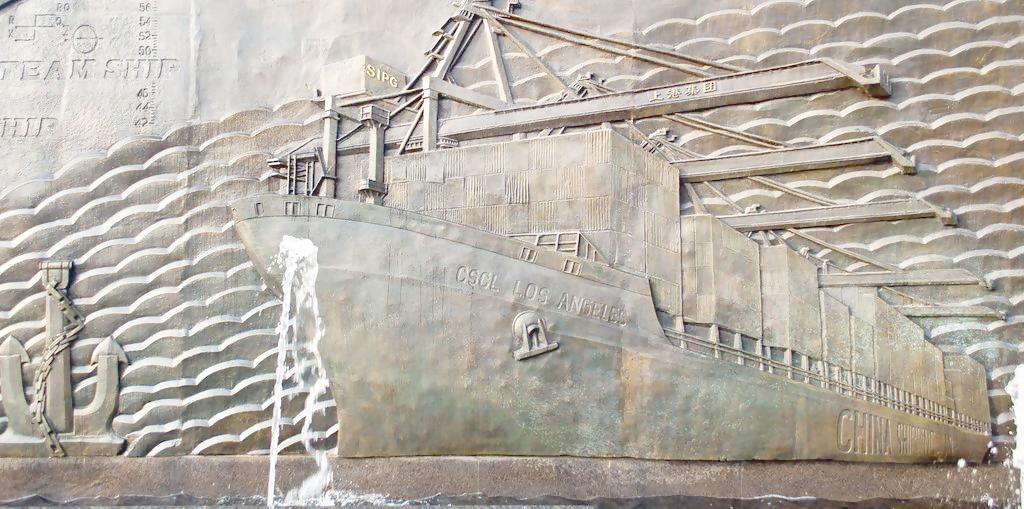

In the spate of consolidation, driven by the merger of the two giants of China’s shipping industry has become a reality. February 18 this year, the China Ocean Shipping Group was formally established in Shanghai, so the “Chinese God Games” will be turned out.

China Ocean Shipping Group can be called “God Games” because of its large volume really eye-popping. Group’s total assets of up to 610 billion yuan after the merger, not to mention the people shelter, employs 118,000 people, is truly “giant”, the scale of its operations is to achieve the world’s first five One, five, “the world’s attention.” .

One is the world’s first five:

One is a comprehensive capacity. Group operates an integrated fleet capacity 85.32 million dwt, 1114 boats, ranking first in the world One.

Second-owned dry bulk fleet capacity. A total of 33.52 million deadweight tons, 365 vessels, the world’s No. One;

Third, the tanker fleet capacity. A total of 17.85 million deadweight tons, 120 vessels, the world’s No. One;

Fourth, specialty groceries fleet capacity. A total of three million deadweight tons, ranking first in the world One.

Fifth, ship fuel sales. Global sales of over 25 million tons, ranking first in the world One.

Five “global attention” as:

One container terminal. With nearly 50 terminals, the number of more than 190 berths, container throughput of 90 million TEU, ranking second in the world;

Second, the container fleet. 158 million TEU of accommodation, ranking fourth in the world;

Third, the container leasing scale. More than 2.7 million TEU, ranking third in the world;

Fourth, the shipping agency business ranking in the world;

Fifth, marine engineering equipment manufacturing orders scale global attention.

This impressively out of the monster, so global counterparts dismay, the industry exclaimed: China Ocean Shipping Group was established, and will break the sphere of influence of the four largest reconstructed ISF!

“God” on the soul?

Aviation enterprises Why such a big mess? Because shipping deep trough, must hold together for warmth.

Aviation enterprises believe that the reason why the “big” can save the world, because the shipping and long cold winter, it is tough. Since the 2008 global financial crisis, the shipping industry for years in the doldrums. As a barometer of global shipping sea wave logic Dry Index BDI free fall One way to fall, from May 2008, the highest 11793 points, down to the current less than 300 points, it has fallen by 98%.

Such a grim situation, so that in recent years, COSCO and China Shipping’s operating results are consecutive losses. COSCO in 2011, 2012, huge loss for two consecutive years, and then one of a “loss of the king” A shares. In 2015 the amount of loss, more than doubled in 2014 One times. The performance is good, excellent reputation CSCL, the first three quarters of last year went so far as loss of 1.034 billion yuan, embarked on the road of loss. Last year, the world’s fourth-quarter freight rates plunged again, to the two companies brought more heavy losses.

Today’s global shipping has come to “ice, A thousand Piao,” the ice age. Freight shipped from Europe to South America, has dropped to the point where the poor received only $ 25 for each standard container freight. Or no down tariffs, tariffs shopping has lost its original meaning of the competition on.

“We will likely encounter since 1980. One of the darkest periods.” The world’s largest international shipping organizations – sea wave logic of international shipping associations (BIMCO) famous shipping analyst Peter Sander that “excess capacity, supply and demand do not balance, fuel cost reduction, an important reason for this round of sea waves logic dry bulk index hit a record low, however, another factor one – slowing Chinese demand is likely to be delayed to a greater extent in international maritime recovery healthy time. “According to Peter Sander predicted that the global shipping the” winter “, will likely continue into 2017.

Thus it appears the M & A and alliances between shipping companies. This is the “Chinese God Games” turned out of the overall context.

However, the body can be a huge amount out of the woods? Many people in the industry do not think this ocean.

First, the stock market is not ungrateful. Late last year, after COSCO and China Shipping announced merger plan, the capital market is not optimistic about the two future business prospects. Last December 25 China COSCO, CSCL resume trading limit that day, ten days after a cumulative decline of 30.2% and 27.4%.

Why not optimistic about the “God of Luck” business prospects?

Its One, the formation of “God Games” is the result of the executive-led. COSCO, China Shipping Group, the two merge, do not belong to the enterprise market and spontaneous behavior, in the third quarter of last year, when the public multimedia coverage of COSCO Shipping will merge the two companies have issued a notice on media reports and repeatedly denied clarify that the media on hearsay evidence, read too much. The two merged to become a reality in the fourth quarter, the previous statement is the real business idea or just revealing the secret, true or pseudo-self-evident.

Hearsay evidence worth mentioning, worth mentioning read too much, no matter how foreign the integration of the plight of struggling Chinese shipping, it is a good thing. For it so good, why it has been set in the upper Jue heart, and have started Shihai merge operation is repeated in the “clarification”? Study these “clarification” announcement, there is a common idiomatic One reason that “has not been derived from any Government information about the merger. ” It seems overwhelmed by the integration of major policy Jue and promoters from government departments, rather than their own strong self-help behavior.

A horse is not sweet. No wonder the Chinese shipping integrate the foreign crewmembers, hobbled. This tweaking of the state, the year when the Maersk Line, Mediterranean Shipping and CMA CGM was founded P3 alliance with decisive stand Jue, invincible strides forward to form a sharp contrast to how. Because the latter is the market demand, desire their own survival and development.

Not the market leader, it is difficult to obtain market expectations. I once worked with in 18 years of COSCO network of people, who have heard a lot of mergers and who should, and who should be the boss of the merger, the headquarters is located in Shanghai or Beijing talk. Although the China Ocean Shipping Group has been listed for three months, and the whole sub-pain everywhere, many employees showing lament, regret, frustration, fear of being laid off, ready to jump ship sad. This state of mind is not possible to win in fierce competition.

Second, asset transactions combined complex. After the merger involves four listed companies in China and Hong Kong a total of seven stocks, including more than 70 asset deal, the first of China’s capital market, the degree of complexity of home, is nearly 20 years on the international capital market is extremely rare asset restructuring transactions.

Third, the backbone of the business loss. One straight COSCO headquarters in Beijing, China Ocean Shipping Group with the transfer of the headquarters to Shanghai, will inevitably involve a large number of employees off-site arrangements One more family and I backbone of the business is likely to adjust positions in the merged quit loss.

COSCO, China Shipping are due to many years of huge losses, and be challenged as “big but not strong,” Today, the company after the merger to enhance the size alone can reverse the loss? Downturn in the shipping industry as a whole, and the huge volume of assets how to optimize complex business sector coordination? these questions become placed in front of the newly established China ocean shipping Group challenges. One explanation very much agree with industry experts, “in the shipping industry downturn, large-scale and can not bring profit, after the merger depends on the effectiveness of the next efficiency does not improve, there is no lift service, there is no route optimization, costs have not reduced. ”

This challenge comes from three aspects: One is shipping customer care integration. Due to high customer care dispersion shipping business, so the integration complexity is very large. We need to restructure the sales network cheese, docking route layout and docking, container management system, coordination of its feeder shipping company resources, negotiating rates adjusted trailers, docks and other rates, voluminous imagine.

When people look forward to “Chinese God Games” can have a new business performance, the China Ocean Shipping Group chairman Xu Lirong also concerned with the integration troublesome. In his view, the main difficulty lies in the integration of top-level design, including core business structure, organizational structure and the determination. So we see the extent of its troublesome stepped boasted he did not dare “do not break the Loulan not also” rhetoric, but carefully, treading on thin ice.

Among away, when the integration of the sea just fetal movement, the global shipping market has fallen shipping giant after another came the bad news:

Late last year, South Korea’s largest supplier of dry bulk shipping One – A big wave of international shipping companies officially entered bankruptcy proceedings. This has been to create the world’s “most powerful and excellent” international shipping companies for shipping companies targeted in the dawn of 2016 is not now when it comes to this “Pathetique” way to end all of its operations.

International shipping is not the first big wave One by one down the “Big Mac.” Than two months earlier, in the worst shipping market has been struggling to get “exhausted” the Danish shipping giant Copenship and well-known in China Dalian Winland shipping companies have also collapsed.

It seems, “big” is not safe shipping companies, nor is it a panacea for Threatened life insurance.

“Big” or small?

Philosophers Aristotle in his discussion of the aesthetic basis that, in geometry, with a medium for the United States. Too small loss of macro; then the loss of much of the microscopic. So inference to enterprises of all sizes, which should be based on the size of the market situation better.

In terms of the merger seeking large, seeking the best in terms of restructuring, mergers, the more fit the larger; recombinant One is not given, but to demand and market competitiveness of enterprises, the need for big large, need little small. Concept of Reform of Chinese enterprises to merge instead of restructuring abound, seemingly to integrate strong, but in reality only see great. From operational terms, the merger is much easier than restructuring, much effort, effective much faster, have become accustomed to fast track short cut of Chinese enterprises, the first choice for this type of reform say the merger has its inevitability.

When the Chinese aviation enterprises to “God” and, when combined, can not believe the size of the industry giant Maersk able to withstand the winter, when the storm spent. It has taken the strategy of China’s aviation enterprises seeking big opposite: full-scale reductions, which should be in a difficult market situation.

Its called drastic reduction strategy. The third quarter of last year, in order to enhance the competitiveness of Maersk, continue to reduce the cost of a single box, to meet market challenges more difficult to develop and implement a reduction strategy: to cut capacity, defer delivery of the vessel, the suspension of investment and adjusting the fleet size and the like. Maersk last year canceled the voyage four routes 110, of which nearly half One voyage is canceled in the fourth quarter of last year. Meanwhile, Maersk respectively surrender of 84,000 TEU and 32,000 TEU of idle capacity and postponed a new custom-made boat plans.

One step forward in order to reduce costs, improve efficiency, Maersk Line also initiated adjustment of institutions and employees. Including North Asia and Asia Pacific merger, China big six, Hong Kong, Taiwan and integrated into the new Greater China. One step forward in order to reduce costs through the hook inside and Maersk and customer care, even to the world’s remaining business segments reduced to seven. And propose a plan at the end, to cut 4,000 jobs within two years.

Maersk One round of this reorganization, fewer routes, fleet smaller, inter-agency fine, the staff reduced, thinner layers of management, while bringing significant cost reductions, improved efficiency, competitiveness greatly enhanced. When large and small shipping companies for losses frown on clouds One piece shipping market can not afford to struggle when Maersk Line but then their position in the industry have great confidence. “In the past three years, the implementation of cost-optimized straight-One strategy, in terms of relative and absolute terms, Maersk Line is the industry better profit of the company. In the case of the vagaries of the market environment, our strategy is effective of our strength in the financial, commercial and operational level will enable us to continue to lead the market, continue to grow. I believe that in 2016 will be, too. “Shi Ren cable its president.

Faced with painful shipping market in 2016, Maersk Line’s goal is still to achieve full-year pre-tax profits leap higher than 5% of peers!

In such a difficult situation, to Betty Maersk dare release of rhetoric, perhaps this is the difference between an eagle and chicken cage.

Variety, quality, brand is to survive

Enterprise integration have become the trend of the times, this is because: One, it can suffer with the global competition for the realization of joint China, economies of scale; One other aspect to be the solution in many industries Jue serious overcapacity problem. In essence, large state-owned enterprises to promote integration, help reduce the vicious competition in the relevant large-scale state-owned enterprises, reducing the risk of its internal friction influence, enhance the ability to compete with the international giants.

Therefore, eighteen Third Plenary Session of the requirements, state-owned enterprises to come to the market, the market allocation of resources. The international business needs, but also require its resources to achieve scale One set standards, and to enhance the ability of the right to speak in the international market.

But this integration is not to expand the number on the scale to pursue after the merger, and that the internal mechanism of sublimation. If the inner mechanism does not change, no transformation, but this merger will bring puffiness, more bloated and low efficiency, resulting in a greater risk of the enterprise, governance more difficult to make state-owned enterprises have been very complex personnel arrangements, governance design more complicated. Sinotrans and CSC shipping two merger cases in particular, is worth considering. Just as former SASAC Director Li Rongrong said, if there is no board of directors and corporate governance norms, companies had to fall, they are not sustainable. Direction of SOE reform is to establish a modern enterprise system, the core of governance.

What to governance as the core objective is Li Keqiang Jiabao in his government work report in 2016 two of the country pointed out that the essence of corporate reform:? Encourage enterprises to carry out customization, flexible production, foster excellence artisan spirit, increase varieties, improve quality , a brand.

Global shipping are painful transition stead, necessarily breed shipping service, quality, brand sublimation. Let the owner to enjoy convenient, fast and economic services. Reform of China which should be shipping this era trends and market demand, forced on the core mechanism. If you grasp the essence of the enterprise reform, “the merger is not reform,” good integration has become a true merger “god.”

Downturn in the global shipping market spawned integration among enterprises, but this integration should be efficiency-type merger, it is full of vigor and vitality of the restructuring. Capital markets are keen to bring new life business integration, investor hopes, of course, the result is not a single room 1 + 1 = 1, but hope that through the process of integration, driven by substantial across the enterprise. This ocean is urgent and necessary reform, but also the community hope and would like to see.

Global shipping is still heavy haze, dark. Even profitable 110 years Maersk Line, both in the fourth quarter of last year, there has been a terrible loss, showing the extent of the downturn in the market is how the deep ocean. Urgent need of reform difficult market Chinese shipping a shooting, only this ocean of reform, China can save shipping. If using only integrated media foam, in the capital market churning concept and hype, combined shipping enterprise competitiveness in the market, operating cost control, efficiency and other aspects of the service mediocre achievements, in my eyes this can only be regarded as two foreign Integration one big chicken just got a more luxurious chicken worm, when the ruthless market swept through, leaving nothing but the one shining white feather. China shipping long way to go, I hope the club had degenerated into fighting the sky eagle!

No Comments Yet.