European energy crisis continues to ferment! LNG carrier daily rent doubles year-on-year

- Date: Sep 15, 2022

- Comments: no comments

- Categories: News

Financial Associated Press, September 6 (Editor Li Chen) Affected by energy shortages and geopolitical conflicts, rising natural gas demand and freight rates have pushed up the freight rates of LNG carriers. Since the beginning of this year, the average one-year time charter rent of LNG carriers has increased by 47% year-on-year. Higher demand and higher freight rates also led to an increase in newbuilding orders.

The Spark Commodities report shows that daily rates for LNG carriers rose to $105,250 between mid-September and mid-November, 64% higher than the current rate of $64,000 a day and 124% higher than a year ago. The report said the number of ships currently available has fallen sharply as traders book LNG ships in advance to handle gas deliveries.

According to media reports, Jason Feer, head of business intelligence at shipbroking firm Poten & Partners, said that two months or more from now, only one available LNG carrier will be able to make a single voyage in Asia, while one in the Atlantic nor. According to the current incomplete statistics, the new orders for large LNG carriers from January to August are 109 and 75 for the whole of 2021.

Rystad Energy estimates that South Korea, the world’s largest LNG carrier producer, will have no new capacity until 2027 as dealers book more LNG carrier orders.

Shenwan Hongyuan’s recent research report also pointed out that as of August 2022, the cost of a new LNG carrier with 170,000 CBM is US$240 million, which is about 2.0 times that of a VLCC and 3.7 times that of a Capesize bulk carrier. Analysts believe that the Russian-Ukrainian crisis has contributed to the outbreak of high value-added orders for LNG ships, and the income space of shipyards with LNG construction capacity per unit capacity has opened up.

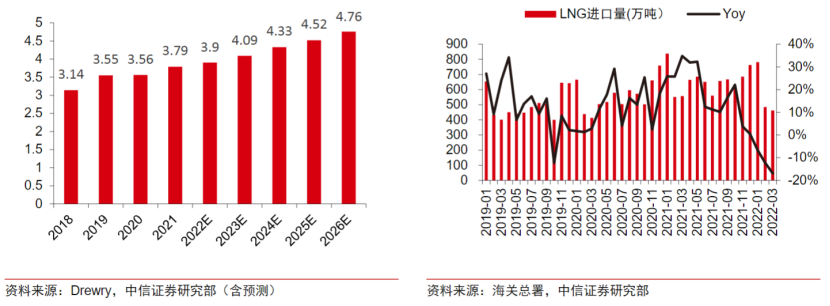

The LNG business is developing rapidly and the shipbuilding cycle is on the rise. CITIC Securities stated in a research report released on July 19 that the CAGR of LNG trade volume from 2021 to 2026 is expected to be 4.6%. The increase in the supply of LNG in the United States is expected to lengthen the shipping distance and push up the demand for LNG transportation. According to data from the General Administration of Customs, China’s LNG import volume in 2021 will be 78.93 million tons, a year-on-year increase of 17.6%, making it the world’s largest LNG importer.

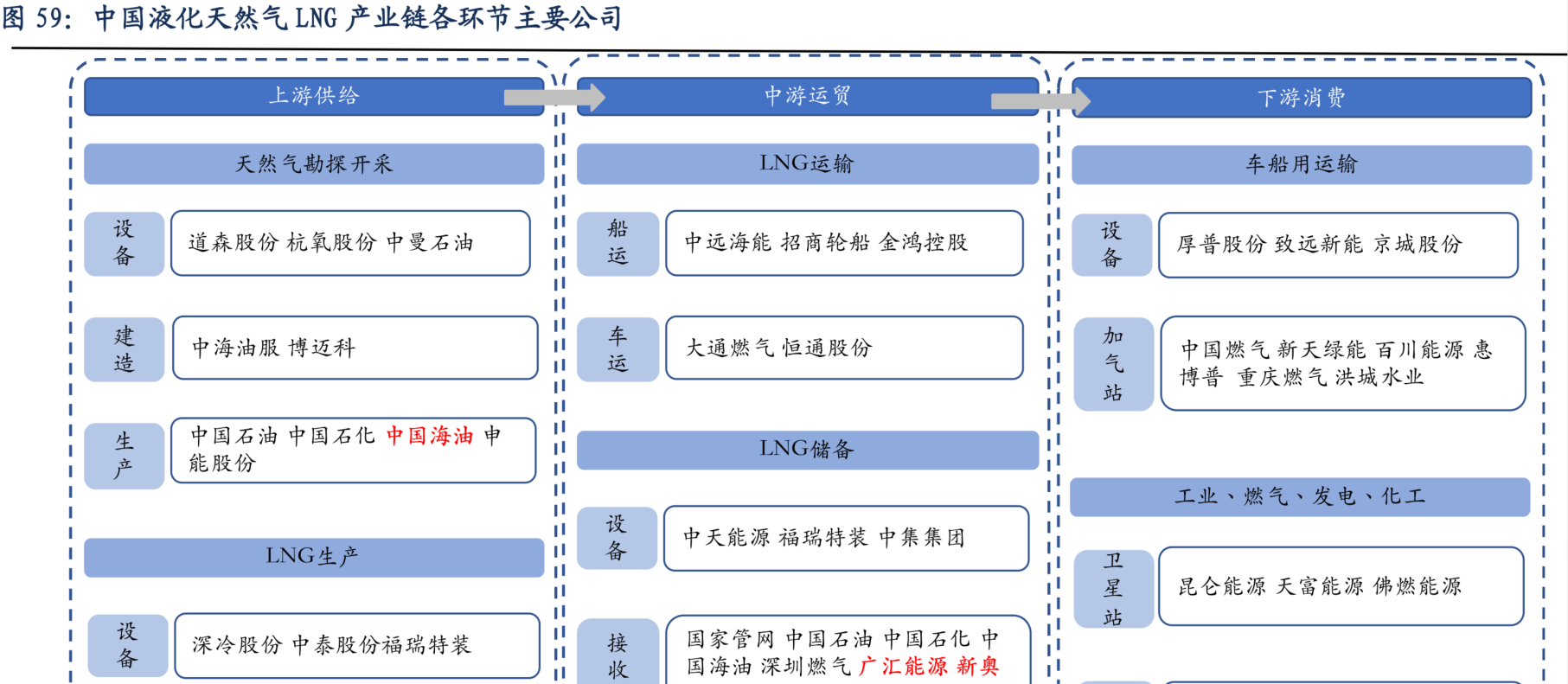

From the perspective of the industry chain, LNG ships are located in the middle reaches, and the main companies involved are COSCO SHIPPING Energy, China Merchants Steamship, and ST Jinhong. In addition, Furui Special Equipment stated on the interactive platform on September 2 that the company has LNG storage tanks, LNG marine fuel tanks and other products sold to Europe.

The LNG ship market has the characteristics of a single product, fixed transportation routes and upstream and downstream customers, and high cost per ship. Therefore, the project binding system is usually adopted, and a 15-20-year long-term lease is signed for natural gas transportation of designated projects. As of the end of June 2022, there are a total of 696 LNG ships in the world, of which about 80% are project ships, which cannot be engaged in spot market transportation in the short term. Therefore, the supply of ships in the spot market is in short supply, which pushes up the freight rate in the spot market.

Liu Jing of Huajin Securities said in a research report released yesterday that LNG ships “surpassed” container ships to become the protagonist of the market, focusing on Chinese ships. The company is a listed company in the core civilian products and main business of CSSC. It integrates large-scale shipbuilding, ship repair, power and mechanical and electrical equipment, marine engineering and other businesses under CSSC, and has a complete industrial chain of the shipbuilding industry.

The LNG shipping market is in an excellent period since its birth. This window period is expected to last for about 3 years, but the cycle is unavoidable, and shipowners need to consider locking long-term contracts. Industry insiders said that while domestic shipyards are steadily increasing the production capacity of LNG carriers, shipping companies must also prevent rushing in and pay attention to the operational risks brought about by the large-scale expansion of production capacity.

No Comments Yet.