In February, the throughput of nine of the top ten ports in the United States decreased, while the Port of Los Angeles experienced a year-on-year drop of 43%

- Date: Mar 23, 2023

- Comments: no comments

- Categories: News

The throughput of Los Angeles Port in February was 487846 TEUs, a year-on-year decrease of 43%, making it the worst February since 2009.

Gene Seroka, Executive Director of the Port of Los Angeles, said: “The overall slowdown in global trade, the extension of the Asian Lunar New Year holiday, warehouse backlog, and the transfer of West Coast ports exacerbated the decline in February.” Although it is expected that the freight volume will improve in March, it may still be lower than the average level in the first half of 2023. ”

These data clearly depict the slowdown in container transportation after the epidemic driven surge in freight that began to subside last summer. In February 2023, the loading and import volume was 249407 TEUs, a year-on-year decrease of 41% and a year-on-year decrease of 32%. The export volume was 82404 TEUs, a year-on-year decrease of 14%. The number of empty containers was 156035 TEUs, a year-on-year decrease of 54%.

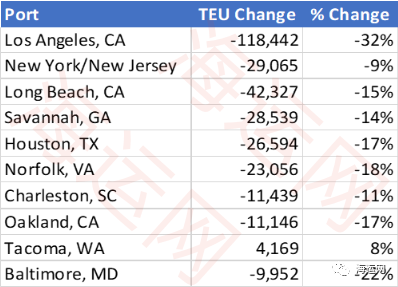

Comparison of US Top 10 Port Import Volume from January to February

In February 2023, the overall container import volume of the top 10 ports in the United States decreased by 296390 TEUs, with the exception of Tacoma Port, other ports experiencing a decline. The decrease in the total volume of containers at the Port of Los Angeles was the largest, accounting for 40% of the decrease in the total volume of TEUs. It is the lowest level since March 2020.

Imported containers at the Port of Los Angeles decreased by 41.2% to 249407 TEUs, ranking third in terms of imported cargo volume, after New York/New Jersey Port (280652 TEU) and Long Beach Port in San Pedro Bay (254970 TEU). At the same time, imports from ports in the eastern United States and the Gulf of Mexico decreased by 18.7% to 809375 TEUs. The United States and the West continue to be affected by labor disputes and the transfer of import shipments to the East.

At the cargo press conference last Friday, Gene Seroka, Executive Director of the Port of Los Angeles, said that compared to 93 calls in the same month last year, the number of ship calls in February this year decreased to 61, and there were no fewer than 30 stops in that month.

Seroka said, “It’s true that there is no demand, and U.S. warehouses are still basically full. Retailers must clear inventory levels before the next wave of imports arrives. However, as everyone is concerned about the economy and consumers continue to be under inflationary pressure, inventory removal of overstocked goods is slow.” He added that even when American media reports that retailers have decided to clear inventory, even with significant discounts, it is not possible to complete inventory removal. Seroka said that although the throughput is expected to improve in March, it will decrease by about one-third month on month, and will be “lower than the average level in the first half of 2023.”.

In fact, data for the past three months show that US imports fell by 21%, further down from the negative growth of 17.2% last month. In addition, the significant decline in the number of empty containers shipped back to Asia is further evidence of the global economic slowdown. The export volume of Los Angeles port this month was 156035 TEU, lower than 338251 TEU in the same period last year.

In 2022, the Port of Los Angeles was rated as the busiest container port in the United States for the 23rd consecutive year, with a throughput of 9.9 million TEUs, making it the second highest year on record, second only to 10.7 million TEUs in 2021. The throughput of Los Angeles Port in February was 10% lower than that of February 2020, but 7.7% higher than that of March 2020. Last month was the worst February for Los Angeles Port since 2009, when the port handled 413910 TEUs.

笔记

No Comments Yet.