Pacific Shipping: The worst time in the market is over

- Date: Oct 18, 2016

- Comments: no comments

- Categories: News

While Pacific Shipping has a track record of exceeding market averages and believes that the worst of the market is over, it will continue to do business in the mid-term, weak market

October 6, Hong Kong-listed the world’s largest small handicraft bulk carrier Shipowner Pacific Shipping (02343.HK) issued a notice to reveal the third quarter of the enterprise and market-related trading activities.

Day rents increased substantially

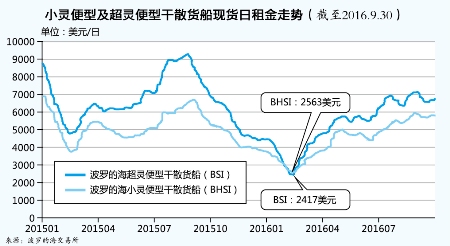

Pacific Shipping said that the third quarter, the handicrafts and super-smart dry bulk cargo ship spot market average daily net rental value of $ 5,500 and $ 6,710; by the increase in freight and market prices since February, pulled up low, average daily Rents increased 21% qoq and 22% qoq, but down 8% yoy and 20% qoq respectively, indicating that the freight market is still depressed.

In the third quarter, the daily average revenue of the Pacific Ocean Handicap and Super Handy dry bulk carriers was US $ 7,040 and US $ 7,340 respectively. The average daily income in the first three quarters increased to US $ 6,400 and US $ 6,430 respectively, up 44% twenty one%.

In the first three quarters, China’s imports of dry bulk cargo rose by 6.5% year-on-year. Among them, iron ore and coal increased significantly (the latter mainly due to reduced coal production); timber freight volume growth; steel exports in June to reach record highs, in the third quarter softened.

International transport, following the strong performance of South American agricultural exports in the first half, the US food exports in the third quarter showed a seasonal active, especially soybeans and corn exports.

Mats Berglund, chief executive of Pacific Shipping, said after reviewing the performance of the third quarter, indicating that the worst time in the market has passed, the business performance improvement can be expected. He pointed out that the dry bulk transport market began to rise in February from the low, freight, freight both increased, companies have to wait for business recovery.

The market is still challenging

Clarkson expects the overall demand for dry bulk carriers to increase by about 1.5% YoY and to grow 1.8% YoY. In the third quarter, the price of second hand small handy dry bulk carriers of 5 years old increased to US $ 10.5 million, up 13% from the second quarter’s market low. But Clarkson expects new shipbuilding prices to maintain $ 19.5 million, the new shipbuilding prices and second-hand ship price gap between the significant will continue to combat new shipbuilding orders, so the third quarter orders can be described as insignificant.

Pacific Shipping said the first half of the market is extremely weak, the supply side of natural repair help to reduce excess capacity in the market, but the scrapped in the third quarter to reduce, so dry bulk fleet capacity is expected to achieve net growth next year. The Ballast Water Management Convention will enter into force in September next year, which will increase shipowners’ pressure on older, weaker dry bulk carriers to relieve supply of surplus capacity.

Focus on dry bulk cargo transportation business at the same time, the Pacific Ocean shipping began to withdraw from some of the pre-entered the industry, such as ro-ro ship, tug and other services. Last year, the Pacific Ocean shipping out of the ro-ro ship and most of the tugboat business, cash 140 million US dollars, a net loss of 18.5 million US dollars, compared to 2014 the same period 285 million US dollars in losses, reduced losses 94%. Pacific Shipping stated that the net book value of the tugboat assets was approximately $ 18 million at the end of June and that a sale agreement would be concluded for the remaining tugboat assets which, upon completion, would generate approximately $ 3 million in cash, Book loss of about 200 million. All remaining tug assets are not pledged, so asset sales will contribute cash contributions to Pacific Ocean Shipping.

Looking to the future, Pacific Shipping believes that the dry bulk cargo transport market is still challenging, the average market rent at a loss level, the market must increase the amount of scrap to balance supply and demand. Pacific Shipping is working to reduce costs further and reduce the daily operating expenses of dry bulk carriers by utilizing economies of scale and without affecting the safety and maintenance of dry bulk carriers. In the first half of next year, the Pacific Ocean Shipping Hong Kong headquarters will move out of Hong Kong’s central business district, this will be substantial savings. In addition, at the end of Pacific Ocean will set up an office in Rio de Janeiro, which will help increase its cargo volume, to maintain its many customers located in the east coast of South America.

No Comments Yet.