New potential energy: Shipping futures “dopamine” remains unabated

- Date: Dec 10, 2024

- Comments: no comments

- Categories: News

The Shanghai Shipping Exchange’s Container Shipping Index (European Line) Futures Salon was themed “Cycle Rotation and Certainty”, sharing the evolution of the global economic cycle, the fundamentals of the container shipping market supply and demand, and typical cases of risk hedging of the container shipping index (European Line) futures.

At the second Pudong Shipping Week, the Shanghai Shipping Exchange’s Container Shipping Index (European Line) Futures Salon received high attention from the market. As China’s first shipping industry futures product, the trading volume and position of this index futures have far exceeded similar overseas products in more than a year since its listing. It can be called the new quality productivity of the container shipping industry, and the market heat has always remained high.

At the salon with the theme of “Cycle Rotation and Certainty”, Shanghai Shipping Freight Exchange Co., Ltd. (Freight Company) and Huatai Futures experts discussed with the audience the impact of global trade changes and the supply and demand of the container shipping market on shipping index futures, and shared practical cases to find the power of certainty in uncertainty.

The evolution of the global economic cycle

The global economy is undergoing a transformation in the inventory cycle. When will this year’s inventory replenishment cycle end? Is the destocking cycle coming? According to Bloomberg data, in 2024, the cumulative inventory of finished products of Chinese industrial enterprises increased by 3.9% year-on-year, and fell month-on-month for three consecutive months; while the inventory of US manufacturing increased to 0.23% year-on-year, and fell month-on-month for two consecutive months. Based on this, Cai Shaoli, director of the major asset allocation group of Huatai Futures, analyzed: “This round of inventory replenishment cycle is likely to end. The new round of destocking will start in July 2024, with an average of 15.6 months, and is expected to continue until the third quarter of 2025.”

Driven by the global economic cycle, the monetary policies of central banks in various countries have also changed accordingly. This year, the Federal Reserve has cut interest rates by 75 basis points, and the European Central Bank has also cut interest rates by 75 basis points, which has a profound impact on global liquidity and asset prices. In terms of global monetary liquidity, the Federal Reserve’s reverse repurchase balance was US$217.7 billion, and the deposit reserve balance fell by US$84.3 billion in September, showing subtle changes in monetary policy. At the same time, the 10-year interest rate of US Treasury bonds fell, the 2-year interest rate rose, and the 3-month interest rate fell. These changes have provided investors with important market signals. China has improved the macroeconomic environment by reducing the deposit reserve ratio by 0.5 percentage points, releasing about 1 trillion yuan of liquidity and enhancing market vitality.

Cai Shaoli pays special attention to the impact of fiscal policy on the industry. In China, the total reduction and exemption brought about by real estate-related policies such as deed tax exemption and land value-added tax reduction is less than 300 billion yuan. In addition, the focus of fiscal policy is on the Politburo meeting and the Central Economic Work Conference in December, which will have a guiding impact on economic policies in 2025. At the industry level, Cai Shaoli pointed out that the destocking cycle in my country’s downstream industries will first affect industries with both profit and inventory declines, such as ferrous metal smelting and rolling processing, petroleum, coal and other fuel processing industries; secondly, it will rotate to industries with passive inventory accumulation but negative profit growth, such as coal mining; and thirdly, it will involve downstream industries with stable profits, such as electronic equipment manufacturing, metal products industry, furniture manufacturing, rubber and plastic products industry, automobile manufacturing, textile and clothing, chemical raw materials and chemical products manufacturing. Overall, the downstream destocking cycle has just started and remains to be determined. If there is fiscal increase, it is expected to be reversed.

In view of the evolution of the global economic cycle, in terms of investment strategy, Cai Shaoli suggested that stock indexes and macro-related commodities should be allocated on dips in the first half of the year, and the possibility of improved commodity demand should be paid attention to in the second half of the year. Precious metals, non-ferrous and ferrous metals are recommended commodities for allocation on dips, while crude oil and energy products are recommended for allocation on rallies. The agricultural product market showed internal differentiation. He stressed that investors should consider the evolution of the global economic cycle, the impact of monetary policy and industry development trends when allocating assets, and also pay attention to risk management, especially in the context of increasing global economic uncertainty.

Challenges facing the shipping market

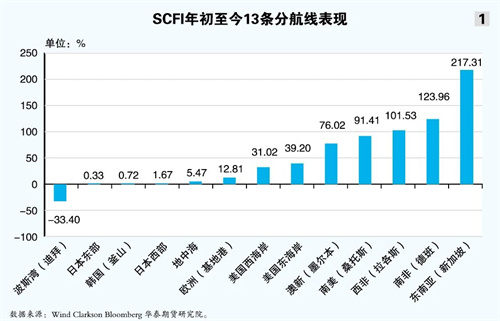

As Cai Shaoli said, with the fluctuations of the global economy, the shipping market is facing unprecedented challenges. Gao Cong, a researcher at Huatai Futures, said at the salon that the volatility of the shipping market has been amplified and the price performance of routes has been differentiated. From the spot market, as of the end of November, the prices of most routes have risen, and only a few routes have fallen, among which the South American route has performed outstandingly among many routes. It is particularly worth mentioning that the price of the Shanghai-European base port route has risen by 12.81% since the beginning of the year. He believes that this change reflects the subtle changes in the global trade pattern and the uneven recovery of economic activities in different regions (see Figure 1).

In terms of forward quotations, in late November, major liner companies have issued price increase letters for December. Mediterranean Shipping’s 20GP and 40GP DT cabins (diamond cabins, similar to first-class cabins on airplanes) December shipping prices have risen to US$3,780 and US$6,300 respectively; Maersk’s 20GP and 40GP December shipping prices have risen to US$3,900 and US$6,000 respectively; CMA CGM’s 20GP and 40GP December shipping prices have risen to US$3,300 and US$6,200 respectively; Hapag-Lloyd’s 20GP and 40GP December shipping prices have risen to US$3,400 and US$6,100 respectively.

On the shipping supply side, by October 2024, the number of new shipbuilding contracts of global liner companies reached 286, with a total capacity of 3.266 million TEUs, showing the shipping industry’s optimistic expectations for future market demand. At the same time, the number of dismantling of old ships is relatively small, indicating that the supply of shipping capacity in the market is still sufficient. In addition, the delivery and inventory data of ultra-large ships have also attracted widespread attention from the market. These ships dominate the routes from Asia to Europe and the Americas. The configuration ratio of 12,000 to 16,999 TEU ships and 17,000+ TEU ships on the European line exceeds 92%; the configuration ratio of 8,000 to 11,000 TEU ships and 12,000 to 16,999 TEU ships on the US line exceeds 86%.

On the demand side, Gao Cong believes that special attention should be paid to the recovery of the European economy. Although recent economic data has improved, due to the resilience of inflation, it is expected that there will be limited room for interest rate cuts in Europe in 2025. This will have an impact on Europe’s import demand, and in turn affect the global shipping market. He also pointed out that the uncertainty facing the eurozone remains high, including changes in US policies and geopolitical tensions, which may have a significant impact on spending and inflationary pressures in the European economy.

What impact do changes in shipping supply and demand have on the futures of the container shipping index (European line)? Gao Cong predicts that after the price increase expectations in the second half of December are dashed, there is still one last upward expectation (the price increase letter in January 2025). After the last price increase letter is implemented, the spot price is expected to turn to a volatile downward trend, and the general direction of trading may also reverse.

After more than a year of analysis and research on the futures of the container shipping index (European line), Gao Cong shared a few feelings. First, the price difference between the futures contract and the Shanghai Export Container Settlement Freight Index (SCFIS) is large, and the price difference range is between -4800 points and 1600 points. Secondly, it is recommended that buyers do what they do in what season, not against seasonality, and not against liner companies. Thirdly, the long-term contract generally follows the fluctuations of the near-month main contract and has no independence.

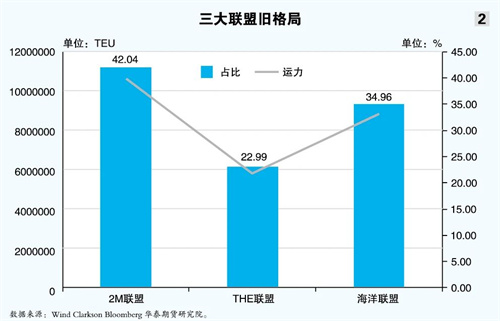

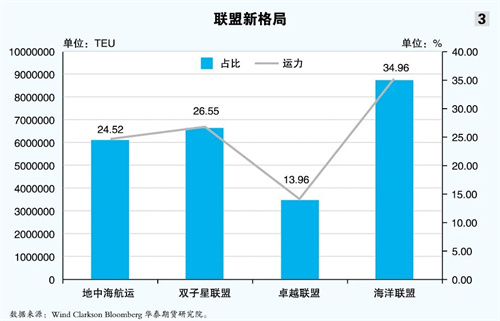

Regarding the future market trend, Gao Cong reminds several points of attention. First, the impact of the US election on the shipping market. Trump’s re-election may trigger a rush to ship goods, which will provide some support for the prices of the US line, but will have less impact on the European line. During the Sino-US trade dispute in 2018, the rush to export caused freight rates to soar. This historical experience deserves the attention of market participants. Secondly, the impact of the establishment of new alliances on the shipping market. With the split of the 2M Alliance and the formation of the Gemini Alliance, the shipping capacity pattern of the shipping market may undergo major changes (see Figure 2 and Figure 3). The operation mode, route layout and cooperation mode of the new alliance will have a profound impact on shipping prices and service quality.

New format of futures and spot linkage

More than a year after its listing, the container shipping index (European line) futures product has been recognized by the industry. According to statistics from the International Futures Industry Association (FIA), the transaction volume of the container shipping index (European line) futures ranked first in the world’s shipping derivatives in 2023, far exceeding other shipping derivatives. It is expected that the container shipping index (European line) futures will remain in the first place in the world in terms of transaction volume in 2024.

The shipping market is full of innovation potential. Based on an in-depth analysis of the futures of the container shipping index (European line), the freight company launched a futures-spot linkage service, which integrates futures into space transactions to form a unique financial product.

At the salon, Shen Shijun, assistant to the president of the freight company, vividly demonstrated the actual effect of the futures-spot linkage model through a transaction case.

In November 2023, the seller’s freight forwarder traded 10TEU with the buyer’s shipper through the April reference quotation of 610 US dollars/TEU through the futures-spot linkage, completing the purchase of space. The freight forwarder then bought the EC2404 contract at the corresponding futures price for hedging. After entering the delivery month, the buyer’s shipper will book a space with the seller’s freight forwarder at 610 US dollars/TEU, and the freight forwarder will close the EC2404 position to achieve hedging. In this process, the freight forwarder’s freight income was US$6,100, the increase in freight costs was the same as the futures profit, and the volatility coverage rate was 102.2%, achieving the expected return. The shipper achieved cost control, and the liner company charged freight according to the spot freight rate level, which was not affected.

In the practice of futures-spot linkage, freight companies remind market participants to pay attention to several key points: the difference between futures-spot prices and spot prices, the distinction between hedging and speculation, and the mastery of financial transactions. These factors are crucial to ensure the smooth progress of transactions and the effective management of risks.

No Comments Yet.